From 6 April 2022, over 1,300 of the largest UK-registered companies and financial institutions will have to disclose climate-related financial information on a mandatory basis – in line with recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD).

Originally formed by the Financial Sustainability Board, the TCFD’s mandate is to encourage uniform climate risk and opportunity disclosure by outlining guidance for disclosures regarding governance, strategy, risk management and climate targets.

Until now, fragmented climate disclosures have made it challenging to measure exposures to climate risk. The government’s decision to aligning with TCFD recommendations, will increase the quantity and quality of climate-related reporting across the UK business community. This to ensure businesses consider the risks and opportunities they face as a result of climate change and encourage them to set out emission reduction goals and sustainability credentials.

Who is affected by the mandate?

Initially, this mandate will cover companies with over 500 employees and £500 million in turnover will have to provide non-financial information statement on their scope 1, 2 and 3 emissions annually with most measures in place by 2023. Number of employees will also include employees working abroad.

While the expansion of the mandate to smaller businesses is planned for 2025, some smaller tier 1 suppliers are already reporting their emissions given that they fall under the scope 3 emissions of larger organisations which fall under the mandatory reporting.

Non-compliance may result of fines of a minimum of £2,500 and a maximum of £50,000.

What needs to be measured?

Companies will have to measure and disclose their scope 1, scope 2 and for first time scope 3 emissions.

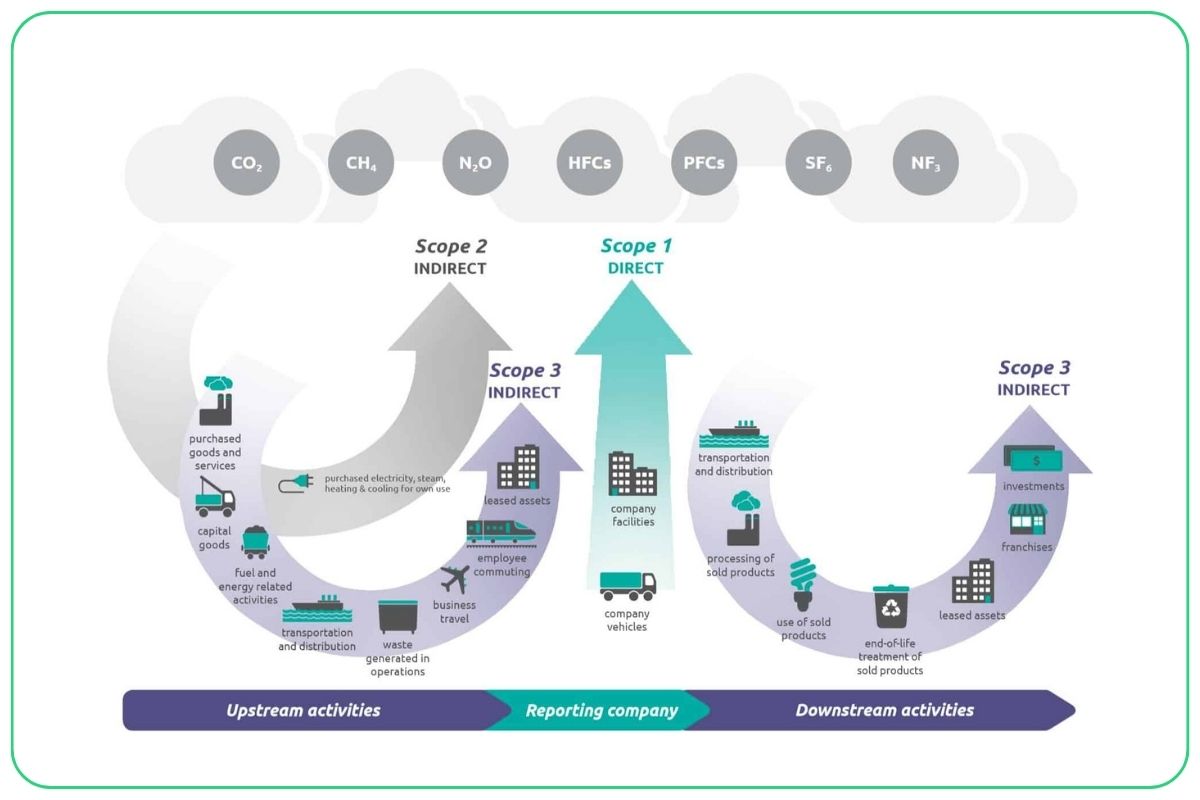

Scope 1 and 2 emissions are those that are owned or controlled by a company such as burning fuel for fleet of vehicles (scope 1) or the energy that is purchased to keep the lights on in the office (scope 2).

Scope 3 emissions are those that are a directly link to the business activity of the company but which it does not have any directly control over. An example of this is employee commuting to work. While the commuting emissions are cause by the company’s business activities it cannot force employees to commute in a certain way.

Companies have so far been reliant on employee travel surveys or extrapolating partial data from expense sheets. Both processes are not cost and time effective and cannot provide the data require for the higher level of reporting that will now be required.

Highly accurate and automated carbon platforms such as TripShift need to be adopted for companies to set realistic benchmarks and reduction goals. By automating the data collection process TripShift enables both companies and employees to focus their time and resources on analysing and finding solution to reduced emissions rather than collecting the data manually or via expense sheets.

By following this this link you can find all the information you need on the TripShift platform.

The road ahead

The major challenge for companies lies in the ability to disclose their scope 3 emissions. Many larger organisations have already been collecting and reporting their scope 1 and 2 emissions. Despite amounting up to 70% of the carbon footprint, Scope 3 emissions where not included has they were deemed too difficult to track.

However, the general trend is now leaning heavily on the mandatory disclosures all three scopes. This is already the case in countries in Europe with carbon taxes already in place in Germany and Sweden.

In March 2022, the United States Securities and Exchange Commission (SEC) proposed a new climate disclosure rule which would require companies registered with the SEC to disclose climate-related information so that investors can consider climate-related financial risks when making investment decisions.

There now is a vital need for business to track report and reduce their emissions. The best disclosures will be based on the best quality data. Businesses will need to provide accurate, up-to-date, credible and detailed data for all scopes, including scope3 business travel & commuting.

Guidance from the TCFD itself can be accessed here, covering metrics, targets and the development of transition plans.

Specifically for UK listed companies, the London Stock Exchange has produced a guidance resource that can be accessed here.